Battery storage is “charging” ahead in New England

ISO-NE continues to remove barriers and expand market access for energy-storage technologies

ISO-NE continues to remove barriers and expand market access for energy-storage technologies

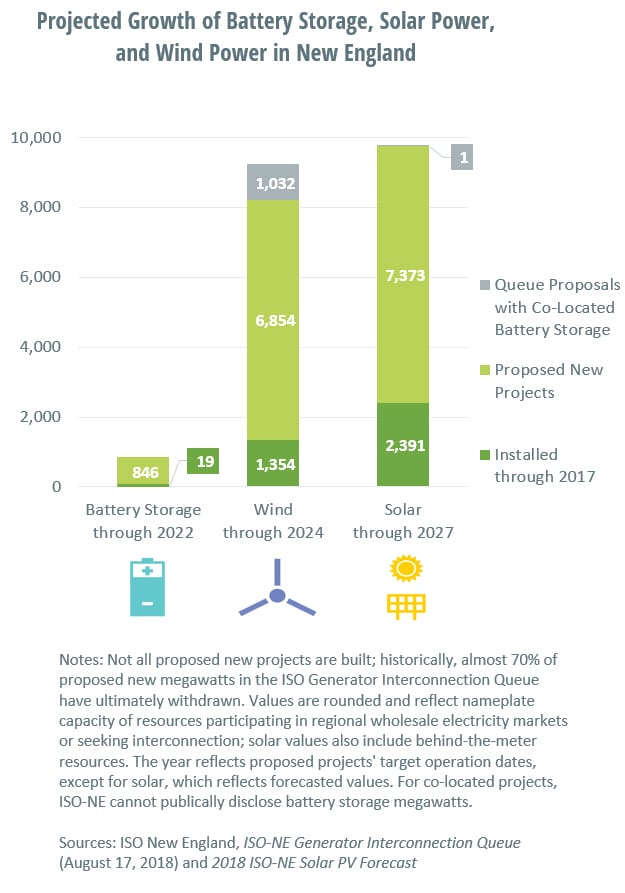

Grid-scale (also called utility-scale) battery storage is coming on fast in New England. While the region’s wholesale electricity markets are already open to battery storage resources, ISO New England is working to ensure they can fully reflect their physical capabilities to the markets. By 2022, currently proposed new projects could add almost 850 MW of battery storage capacity in the region. (ISO Generator Interconnection Queue, August 17, 2018) When compared to the 19 MW that are currently on line, this is a whopping increase of over 4,000%. Additionally, over 1,000 MW of the 9,400 MW of new wind and solar capacity currently proposed in the region will include some amount of battery storage.

State efforts are helping spur batteries and other emerging energy-storage resources

The strong growth in new types of energy-storage resources is being driven by technological advances, falling costs, and support from the six New England states. Energy storage has applications both inside and outside of the markets, and proponents see great potential in energy storage to reduce carbon emissions, increase resiliency, drive down electricity costs, and avoid the need to build new power plants and transmission. For example, storage resources can be used to:

- Help accommodate more wind and solar resources and maximize their emission-free output by storing their excess energy for use later and smoothing out their variable generation through quick discharges of energy

- Reduce congestion and defer transmission and distribution system upgrades by being strategically located and operated in areas with transmission constraints

- “Peak shave” by reducing the amount of energy being drawn from the regional power system during times of high demand—on a local level, this can help utilities reduce future capacity charges

- Provide backup power when storms or other factors cause local blackouts

Examples of State Efforts to Promote Energy Storage

|

|

Connecticut has allowed energy-storage projects to compete in recent requests for proposals for clean energy and grid-modernization. |

|

|

Maine hosts two, utility-scale battery-storage projects. |

|

|

Massachusetts has included a target of 1,000 MWh by December 31, 2025, and approved millions of dollars for policy development and demonstration projects in the MA Energy Storage Initiative. |

|

|

New Hampshire is studying how to facilitate the integration of energy storage and other distributed energy resources (see the Grid Modernization in New Hampshire report). |

|

|

Rhode Island is considering how to incent the deployment of utility-scale and behind-the-meter energy storage (see the 2017 Power Sector Transformation Report). |

|

|

Vermont allows its Clean Energy Development Fund to support energy storage projects and hosts a utility-scale battery-storage project. |

Batteries aren’t the only energy-storage option

New England has a long history of operating the power system with pumped-storage hydropower—a type of large-scale energy storage. These resources can respond very quickly for a sustained period, making them particularly valuable for responding to system emergencies, as well as times of very high demand. Development of new pumped-storage projects in the region is unlikely, however, because of environmental concerns and high development costs. Emerging energy-storage technologies, on the other hand, could offer the region similar benefits, though their run time may be more limited.

Here are some examples of energy-storage resources that exist or are emerging in New England:

- Pumped-storage hydro—These facilities pump water into a reservoir for storage, then release the water to create electricity when needed. New England has two such facilities built in the 1970s, which can supply almost 2,000 MW of energy within 10 minutes and sustain that for over five hours—or supply lesser amounts of energy for much longer periods.

- Batteries—Similar to rechargeable household batteries, these resources use electricity to charge up large battery cells through electrochemical processes. Those cells can later respond quickly to supply electricity by discharging their energy. The two battery-storage facilities that went live in 2017 can nearly instantaneously supply roughly 20 MW and sustain that for 30 minutes. Evolving battery technologies may allow longer duration for new battery projects coming on line regionally.

- Flywheels—In this type of device, an electric-powered motor quickly spins a wheel. Inertia allows the rotor to continue spinning, and that stored kinetic energy can be quickly converted to electricity and discharged back to the power grid, as needed. A flywheel system providing regulation was part of the ISO’s 2008–2015 pilot program to encourage alternative technologies to participate in wholesale electricity markets. That program helped set the stage for the ISO’s redesign of its Regulation Market.

- Electric vehicles—When plugged in, electric and plug-in hybrid electric vehicles can provide power back to the power system or provide regulation service by modulating their charging and discharging patterns.

Market participation by energy storage is a function of many factors

Unlike power plants and other generators, energy-storage resources can act as both generation and demand (i.e., as an electricity consumer): they may draw electricity from the power system or directly from a generating resource (such as a co-located solar or wind facility) as they “stockpile” energy, then they add electricity back to the grid when that stored energy is released. As an example, a pumped-storage hydro unit acts as demand when it pumps water up into the reservoir and as a generator when it releases water through turbines to produce electricity. The “give and take” of energy resources isn’t quite one-for-one—overall, they consume more energy than they provide as operation and inefficiencies eat up some electricity.

Like traditional generators, the region’s larger storage resources—like pumped-storage hydro and large batteries—may be connected to the high-voltage transmission system, their performance may be monitored in real time (i.e., telemetered), and they may participate directly in the wholesale electricity markets. Other storage resources coming on line regionally may be relatively small and connected locally to the distribution system, co-located with a generating facility, or connected at a retail customer, and the ISO may not be able to monitor them in real time, as it would a battery that participated directly in the wholesale market.

While the entire range of ISO markets are open to energy storage participation, an individual storage resource’s opportunities may depend on its size and location, along with the specific way it’s configured and operates. Storage resources that are not directly telemetered can also participate in the markets by aggregating together. And the opportunities for storage resources continue to expand.

The ISO has been enabling more dispatchability of new energy storage technologies—and more changes are on the way

While the existing market framework has allowed battery storage (and other similar technologies) to participate in the marketplace, it didn’t allow batteries and other emerging storage technologies to fully reflect their physical capability to the market. For several years now, the ISO has been working to enhance market rules and systems to address this and increase the dispatchability of such storage resources. Dispatchable resources are those that can start up, shut down, raise, or lower output as instructed by the ISO control room. Because of this ongoing effort, the ISO will meet many of the compliance obligations identified in the Federal Energy Regulatory Commission (FERC) Order No. 841, Electric Storage Participation in Markets Operated by Regional Transmission Organizations and Independent System Operators by early 2019.

Note that the ISO’s market rules use the term “electric storage” as defined in Order No. 841 to mean a resource capable of receiving electric energy from the grid and storing the energy for later injection of electric energy back to the grid, regardless of storage medium. Behind-the-meter storage resources may also be able to participate under market rules for demand resources or as an alternative technology regulation resources (ATRRs).

The major market, system, and operations changes ISO New England has made or is making to more fully enable storage resources include the following:

- The Regulation Market redesign in 2015 included an energy-neutral regulation dispatch signal for storage technologies, such as batteries and flywheels, participating as ATRRs

- The pumped storage modeling project in March 2017 allowed pumped storage to better reflect operating characteristics into their demand bids and improve economic dispatch.

- The Price-Responsive Demand Project implemented on June 1, 2018, enabled demand response to participate in the energy market as a dispatchable resource and provide reserves. This builds on demand resources’ long-standing ability to participate in the capacity market. See “Price-responsive demand explained: Q&A with Henry Yoshimura, ISO Director of Demand Resource Strategy.”

- In the first quarter of 2019, revisions to increase resource dispatchability go into effect, which, along with proposed enhanced storage participation revisions, will enable directly metered electric storage to participate as dispatchable resources in the energy and reserve markets while continuing to participate as ATRRs in the Regulation Market. Under proposed revisions, storage resources as small as 1 MW will be able to participate in March 2019—and as small as 100 kW by December 2019.

All in all, by the end of 2019, even small batteries in New England will have options to participate in all wholesale electricity markets and to provide ancillary services in ways that acknowledge their physical and operational characteristics that are comparable to the options available to conventional power plants.

Learn more

- Categories

- Inside ISO New England

- Tags

- energy storage, hydro, market development, system operations