Price-responsive demand explained: Q&A with Henry Yoshimura, ISO Director of Demand Resource Strategy

Henry Yoshimura, Director of Demand Resource Strategy

Henry Yoshimura, Director of Demand Resource Strategy 6/12/18 update: Expanded information on pay-for-performance’s impact on demand resources.

6/12/18 update: Expanded information on pay-for-performance’s impact on demand resources.

On June 1, 2018, ISO New England launched a new price-responsive demand (PRD) structure that completes the full integration of active demand resources (also known as demand response) into the regional wholesale electricity marketplace. Building on demand resources’ long-standing ability to participate in the capacity market, PRD makes ISO New England the first US grid operator to deploy its active demand resources as part of the energy dispatch and reserve-designation process along with generating resources. Henry Yoshimura, the ISO’s Director of Demand Resource Strategy, explains PRD below, as well as the changes and benefits it brings.

|

What are demand resources? Demand resources, like power plants and other supply resources, are competitive assets that help meet New England’s electricity needs. Instead of generating energy that they can sell, as power plants do, demand resources reduce their consumption of electricity from the regional power system. This reduction is their product—it frees up electricity on the grid that can then be used to serve others. Demand resources accomplish their reduction in grid demand in different ways, with differing degrees of responsiveness:

|

What is Price-Responsive Demand?

It’s a set of market rules, processes, and systems that allow active demand resources to participate in the full range of wholesale electricity markets in New England: the energy market; the reserves market; and the capacity market. This new framework accommodates the fundamentally different way that demand resources operate.

Why did the ISO implement PRD?

PRD was initiated to satisfy federal regulations. In March 2011, the Federal Energy Regulatory Commission (FERC) issued Order 745: Demand Response Compensation in Organized Wholesale Energy Markets. Order No. 745 required that active demand resources be paid the market price for helping to balance real-time supply and demand. Due to the scope and nature of the required changes—in addition to significant litigation at the federal level—it’s taken the ISO several years to fully meet the obligations of Order 745.

ISO New England first implemented programs for active demand resources in 2003. In June 2010, when the ISO implemented the Forward Capacity Market (FCM)—the long-term market that procures capacity to meet the region’s future energy needs—the full participation of both active and passive demand resources was integral to its design. Active demand resources could offer into the FCM on their ability to either reduce their electricity consumption or switch to on-site generators in response to ISO dispatch instructions during capacity deficiencies. Passive demand resources could offer into the FCM based on their ability to reduce electricity consumption during times of peak system demand.

Further integrating active demand resources into day-ahead and real-time markets has been an enormous project, requiring the ISO to not only develop and implement extensive market rule changes, but to update computer systems and processes related to grid operations and market settlement. Consequently, the full integration of active demand resources was achieved in a staged approach. For example, for several years now, active demand resources have been able to offer load reductions in response to day-ahead locational marginal prices (LMPs).

|

“Integrating active demand resources into day-ahead and real-time markets has been an enormous project, requiring the ISO to not only develop and implement extensive market rule changes, but to update computer systems and processes related to grid operations and market settlement.” |

What’s changing under PRD?

With the implementation of PRD, active demand resources have been integrated into the energy and reserve market systems and are dispatched economically based on their energy market offers, just like power plants and other supply resources. More specifically, active demand resources:

- Receive wholesale market payments comparable to that of generating resources for providing energy, operating reserves, and capacity to the New England electric system

- Are able to submit offers to both Day-Ahead and Real-Time Energy Markets

- Can be committed by the ISO a day ahead and dispatched in real time

- Are co-optimized to provide energy and/or reserves in the most economically efficient manner

- Are able to set the price for wholesale electricity

In the FCM, all dispatchable resources receive fully comparable obligations and compensation as other power resources do using the pay-for-performance (PFP) construct (which also went into effect June 1). Under the PFP capacity market design, all resources (including demand resources) with a capacity obligation can be penalized $2,000/MWh for failing to supply energy or reserves when capacity becomes scarce, while resources that over-perform relative to their obligation (including those with no obligation) can receive $2,000/MWh of additional revenue. This performance payment rate is scheduled to increase to $5,455/MWh over the coming six years.

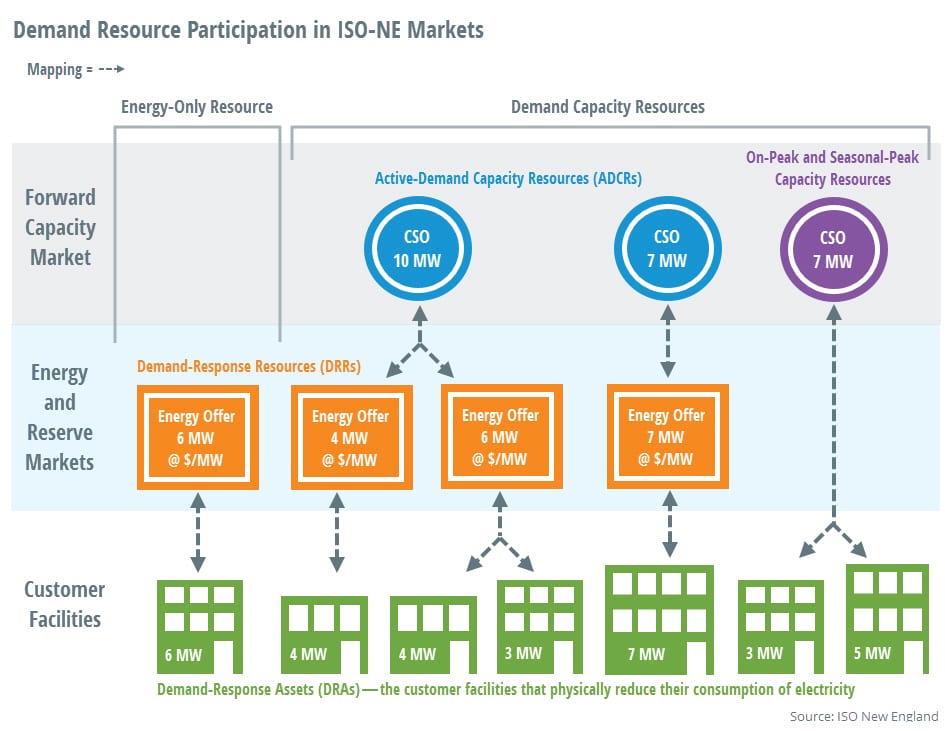

The graphic below illustrates the various ways New England electricity customers can now fully participate in New England’s wholesale electricity markets. Note the hierarchical organization.

- The actual customer facilities that physically reduce their consumption of electricity are known as demand-response assets (DRAs).

- One or more DRAs each under 5 MW can be mapped to a demand-response resource (DRR) that participates in the energy and reserve markets. A DRA that is 5 MW or larger must participate individually as its own demand-response resource.

- Demand-response resources can then be mapped to an active-demand capacity resource (ADCR) for participation in the capacity market.

- Non-dispatchable passive demand resources—the on-peak and seasonal-peak resources shown below—may only participate in the capacity market.

What are the benefits of PRD?

The new economic dispatch of active demand resources should increase the regional resources that participate in energy and reserve markets, thereby making the New England electric system more reliable and competitive.

Learn more

- Price-Responsive Demand (PRD) Overview (slides and webinar recording)

- Customer Readiness PRD Project page

- PRD Key Project page

- Demand resources webpage

- Categories

- Industry News & Developments

- Tags

- demand resources, FERC, forward capacity market, peak demand