Monthly wholesale electricity prices and demand in New England, April 2023

Wholesale power prices averaged $27.25 per megawatt-hour (MWh) in the Real-Time Energy Market in April 2023, down 54% compared to the previous year.1 Day-Ahead Energy Market averages fell to $28.79/MWh, which was also a decrease of 54% from April 2022.

By the numbers

| April 2023 and Percent Change from April 2022 and March 2023 | April 2023 | April 2022 | March 2023 |

| Average Real-Time Electricity Price ($/megawatt-hour) | $27.25 | -54.1% | -11.4% |

| Average Natural Gas Price ($/MMBtu) | $1.88 | -71.0% | -36.1% |

| Peak Demand | 14,606 MW | 1.2% | -9.8% |

| Total Electricity Use | 8,131 GWh | -2.1% | -13.9% |

| Weather-Normalized Use2 | 8,277 GWh | -1.1% | -13.6% |

Drivers of wholesale electricity prices

In general, the two main drivers of wholesale electricity prices in New England are the cost of fuel used to produce electricity and consumer demand.

Power plant fuel

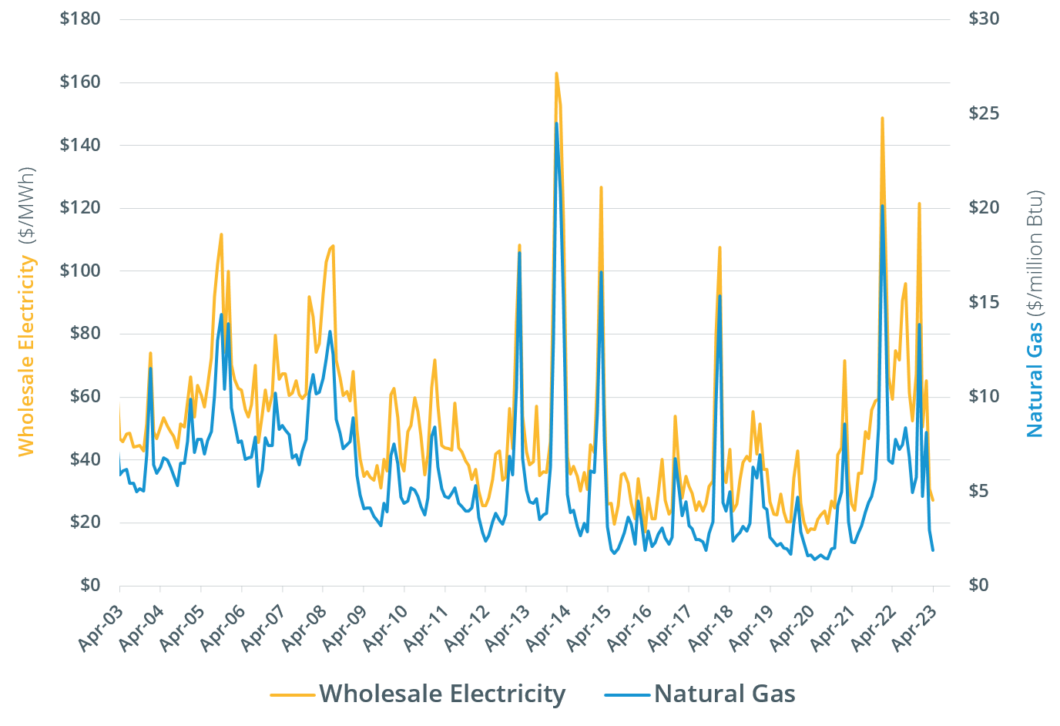

Fuel is typically one of the major input costs in producing electricity. Natural gas is the predominant fuel in New England, used to generate 52% of the power produced in 2022 by New England’s power plants, and natural gas-fired power plants usually set the price of wholesale electricity in the region. As a result, average wholesale electricity prices are closely linked to natural gas prices.

The average natural gas price during April was $1.88 per million British thermal units (MMBtu).3 The price was down 71% from the April 2022 average Massachusetts natural gas index price of $6.48/MMBtu. The Mass. index price is a volume-weighted average of trades at four natural gas delivery points in Massachusetts, including two Algonquin points, the Tennessee Gas Pipeline, and the Dracut Interconnect.

Wholesale electricity and natural gas prices, 2003-2023

Electricity demand

Demand is driven primarily by weather, as well as economic factors.

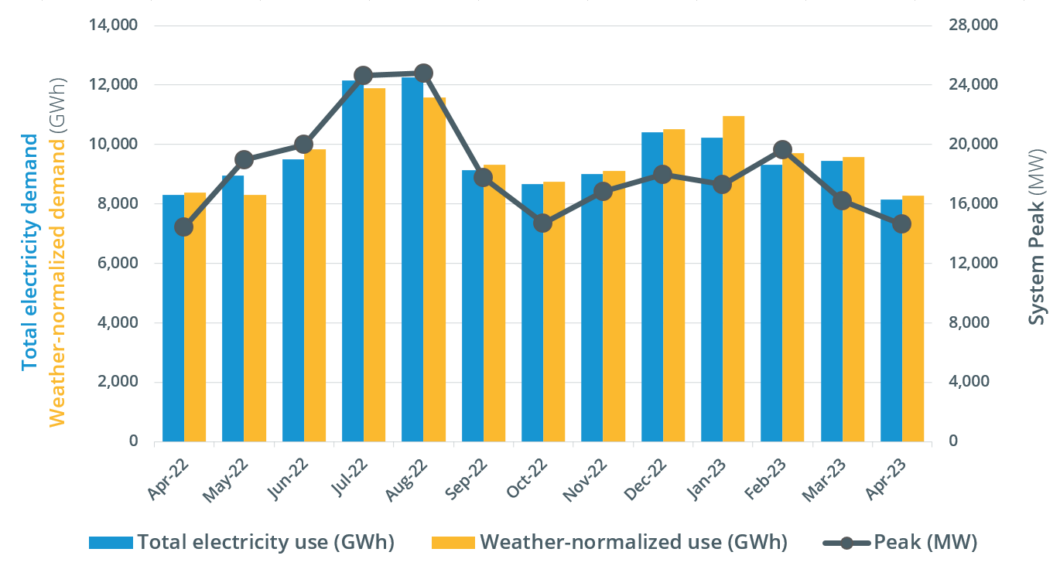

Energy usage during April decreased 2.1% to 8,131 GWh from the 8,307 GWh used in April 2022.

The average temperature during April was 51˚ Fahrenheit (F) in New England, up 3˚ from the previous April. The average dewpoint, a measure of humidity, was 36˚F in April, up 4˚ from the previous April. There were 433 heating degree days (HDD) during April, while the normal number of HDD in April is 524 in New England.4 In April 2022, there were 497 HDD. There were no cooling degree daysin April, which is typical for the region.

Consumer demand for electricity for the month peaked on April 13 during the hour from 7 to 8 p.m., when the temperature in New England was 82°F and the dewpoint was 45°. Demand reached 14,606 MW. The April 2023 peak was 1.2% higher than the April 2022 peak of 14,438 MW, set during the hour from 7 to 8 p.m. on April 7, when the temperature was 46°F and the dewpoint was 40°.

Peak demand is driven by weather, which drives the use of heating and air conditioning equipment. The all-time high winter peak was 22,818 MW, recorded during a cold snap in January 2004 when the temperature was -1°F and the dewpoint was -20°. The all-time peak demand in New England was 28,130 MW, recorded during an August 2006 heat wave, when the temperature was 94°F and the dewpoint was 74°. Air conditioning use is far more widespread than electric heating in New England, so weather tends to have a relatively greater impact on the summer peak than the winter peak.

April monthly peak demand and total and weather-normalized energy use

Resource mix and emissions

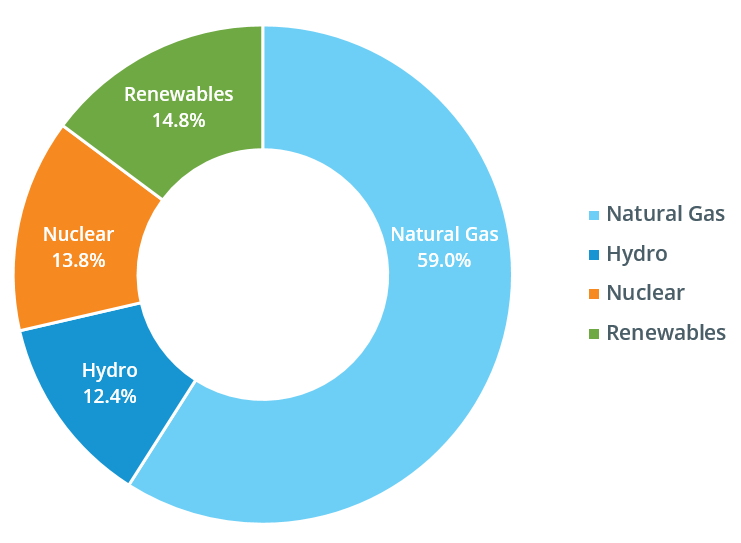

The mix of resources used in any given time period depends on price and availability, as well as supplemental resource commitments needed to ensure system stability. Natural gas-fired and nuclear generation produced about 73% of the 7,242 GWh of electric energy generated within New England during April, at about 59% and 14%, respectively. Renewable resources generated about 15% of the energy produced within New England, including 4.8% from wood, refuse, and landfill gas; 4.5% from wind; and 5.2% from solar resources. Hydroelectric resources generated 12.4%. Coal- and oil-fired resources did not generate a statistically significant amount of electricity. The region also received net imports of about 991 GWh of electricity from neighboring regions.

April generation in New England

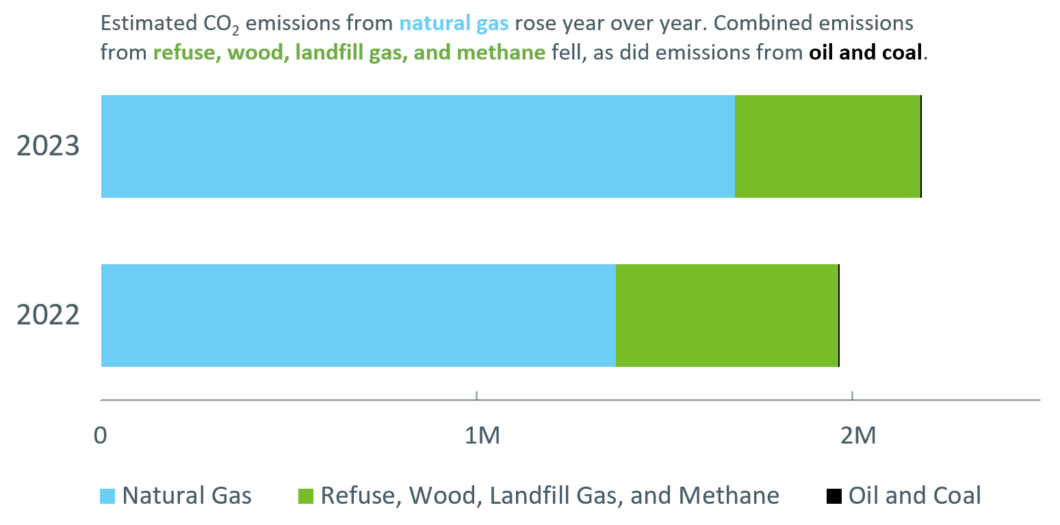

The mix of resources used to produce the region’s electricity is a key driver of carbon dioxide (CO2) emissions. The ISO estimates these emissions through an analysis that blends data on electricity generation by fuel type with an emissions factor for each fuel that is based on data from the Environmental Protection Agency.5

April estimated CO2 emissions in New England, by fuel source (metric tons)

New England power plants produced an estimated 2.18 million metric tons of CO2 in April 2023, an 11% increase from last year.

Estimated CO2 emissions from natural gas-fired plants—typically the largest source of emissions, due to the significant amount of power these resources produce—rose 23% year over year, from 1.37 million metric tons to 1.69 million metric tons. These resources, which produced a larger share of the region’s electricity in April 2023 than in April 2022 (due in part to nuclear refueling outages), accounted for 77% of the power system’s estimated emissions.

Coal-fired resources produced an estimated 1,861 metric tons of CO2, about 0.09% of the total and a year-over-year decrease of 5%. Oil-fired resources produced an estimated 1,346 metric tons of CO2, a year-over-year decrease of 15%. CO2 emissions from other resources—mostly refuse and wood—were estimated at 493,948 metric tons, down 16.5% from last year. These resources accounted for 23% of the power system’s estimated CO2 emissions for the month.

1One megawatt (MW) of electricity can serve about 750 to 1,000 average homes in New England. A megawatt-hour (MWh) of electricity can serve about 1,000 homes for one hour. One gigawatt-hour (GWh) can serve about 1 million homes for one hour.

2Weather-normalized demand indicates how much electricity would have been consumed if the weather had been the same as the average weather over the last 20 years.

3A British thermal unit (Btu) is used to describe the heat value of fuels, providing a uniform standard for comparing different fuels. One million British thermal units are shown as MMBtu.

4A degree day is a measure of heating or cooling. A zero degree day occurs when no heating or cooling is required; as temperatures drop, more heating days are recorded; when temperatures rise, more cooling days are recorded. The base point for measuring degree days is 65 degrees. Each degree of a day’s mean temperature that is above 65 degrees is counted as one cooling degree day, while each degree of a day’s mean temperature that is below 65 degrees is counted as one heating degree day. A day’s mean temperature of 90 degrees equals 25 cooling degree days, while a day’s mean temperature of 45 degrees equals 20 heating degree days.

5The factors used to calculate estimated CO2 emissions were updated in January 2023. ISO New England analysts regularly review and refine the methodology used to develop these emissions factors, in order to reflect the characteristics of New England’s generating fleet and improve the accuracy of the estimates.

Historical weather data provided by DTN, LLC.; Underlying natural gas data furnished by ICE.

- Categories

- Industry News & Developments

- Tags

- monthly prices, natural gas, wholesale prices