ISO-NE report on market price formation highlights complexity of issue, regional improvements

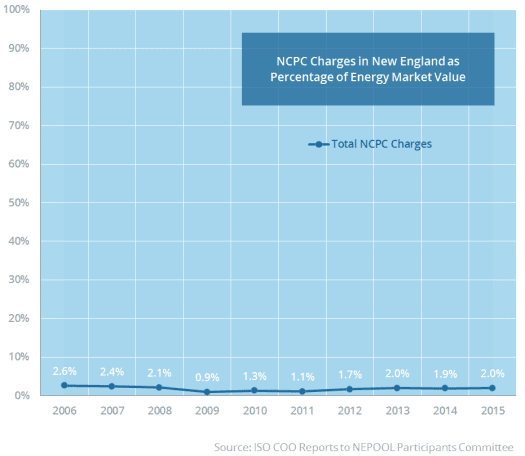

Uplift costs are just 1–2% of the total energy market value in New England

Uplift costs are just 1–2% of the total energy market value in New England

On March 4, ISO New England filed its responses to Federal Energy Regulatory Commission (FERC) questions on price formation in wholesale electricity markets. The ISO report includes detailed answers to the technical, complex issues raised by FERC and highlights the significant strides made regionally to achieve pricing that accurately and transparently signals the costs of operating New England’s power system.

Sound pricing is central to the success and efficiency of competitive wholesale electricity markets because it motivates cost-effective investments—at the right times, in the right amounts, and in the right locations—for delivering the energy consumers demand and for the ancillary services that assure its reliability.

FERC’s questions spanned five related issues: the pricing of fast-start resources; unit commitments to manage multiple contingencies; look-ahead modeling; uplift allocation; and transparency. The Commission posed the same questions to all administrators of US wholesale electricity markets in the November 20, 2015, Order Directing Reports: Price Formation in Energy and Ancillary Services Markets Operated by Regional Transmission Organizations and Independent System Operators.

Recent and upcoming changes are improving price formation regionally

Several ISO market design refinements, made in collaboration with regional stakeholders, and enhanced operating tools improve price formation in New England, including:

- A new methodology for the dispatch and pricing of fast-start resources

- Enhanced modeling of constraints

- Priced locational reserve products

- The adoption of look-ahead modeling tools

For more information on these and upcoming projects, read “Energy Pricing Enhancements: A Roadmap” and explore the ISO’s Key Projects.

The ISO’s efficient operation of the power system keeps uplift costs very low

These and other market improvements have kept uplift costs at just 1–2% of the total energy market value in New England over recent years. The small amount is indicative of a power system operated in the least-cost, most economically efficient manner—to the ultimate benefit of consumers. In New England, uplift costs are referred to as Net Commitment-Period Compensation (NCPC). NCPC is a payment to a supply resource that does not fully recover its start-up and operating costs from the energy market after following ISO dispatch instructions, which is critical for the reliable operation of the power system. (Learn about the different kinds of NCPC.)

Eliminating remaining uplift would be challenging

NCPC values vary depending on factors such as the weather, the price and availability of fuels used to generate electricity, and variations in loads, generation, and transmission mix. For example, bitterly cold polar-vortex weather in January 2014 led to increased NCPC payments for the supply of energy. At that time, oil-fired resources were setting the price of wholesale electricity, which was insufficient to cover the start-up and operating costs of gas-fired resources, due to the high price of natural gas. (Read about how natural gas infrastructure constraints can cause fuel price spikes in New England.)

The ISO report on price formation discusses the complexity of reducing NCPC further. This issue may not have a clear or practical answer, as remaining uplift is related to the amount of time a resource must continue to operate at a minimum output level before shutting down. However, the ISO supports FERC efforts to explore the issue and possible solutions.