New England readies to move ahead with full integration of demand response after SCOTUS decision

With the US Supreme Court’s January 25 opinion on FERC v EPSA, New England now has a clear path forward for enabling demand-response resources to participate fully in the region’s wholesale electricity marketplace. The court opinion affirmed the ability of the Federal Energy Regulatory Commission (FERC) to establish rules for demand response—a matter that had been in question since May 2014 when the DC Circuit of the US Court of Appeals ruled that FERC did not have this jurisdiction. The ISO can now continue with its plans, which had been delayed by a year due to the legal challenges, to create opportunities and obligations comparable to those of generators for demand response to participate in wholesale electricity markets.

With the US Supreme Court’s January 25 opinion on FERC v EPSA, New England now has a clear path forward for enabling demand-response resources to participate fully in the region’s wholesale electricity marketplace. The court opinion affirmed the ability of the Federal Energy Regulatory Commission (FERC) to establish rules for demand response—a matter that had been in question since May 2014 when the DC Circuit of the US Court of Appeals ruled that FERC did not have this jurisdiction. The ISO can now continue with its plans, which had been delayed by a year due to the legal challenges, to create opportunities and obligations comparable to those of generators for demand response to participate in wholesale electricity markets.

“Full integration creates a level playing field for all resources in New England.” |

Commenting on the court decision and project, ISO New England President and CEO Gordon van Welie said, “Full integration creates a level playing field for all resources in New England. Once it’s completed, demand-response resources will be offering into our day-ahead and real-time energy markets just like generators do. When we call on a demand-response resource to operate or to stand by to provide reserves, it will be able to set the price, just like a generator does, if it’s the most expensive marginal resource—and it will similarly be subject to the same pay-for-performance incentives that the ISO has put in place to help ensure reliable resource performance for New England.”

Current demand resources in New England

Both active demand resources (also called demand response), such as the practice of powering down machines or switching to an on-site generator, and passive demand resources (like energy-efficiency measures) have been participating in the Forward Capacity Market (FCM) since the market began in 2010, and even in the transitional period starting in 2006. This long-term capacity market ensures the region has sufficient resources to meet the future demand for electricity. As of February 1, the FCM includes about 420 MW of active demand resources, which relieve grid demand by reducing power consumption in real time, and 1,675 MW of passive demand resources, which have essentially flattened demand growth over the next decade. (These figures can vary by month and season.)

In the energy market, where electricity is bought and sold on a day-ahead and real-time basis, active demand resources have also been able to offer load reductions in response to day-ahead locational marginal prices (LMPs). (Passive demand resources are ineligible.) A small level of active demand resources currently participates in the region’s energy market, but their offers are accepted only after the market has cleared and LMPs have been set; in other words, the offers from active demand resources are not used to determine the optimal dispatch of resources. The full-integration project will incorporate demand-reduction offers into the same energy market systems that currently dispatch the system based on generation supply offers, and will allow active demand resources to provide reserves. The intensive project requires extensive software changes to both the energy markets and system operations infrastructure and will take about two years, with completion expected by June 1, 2018.

Demand resources around the country

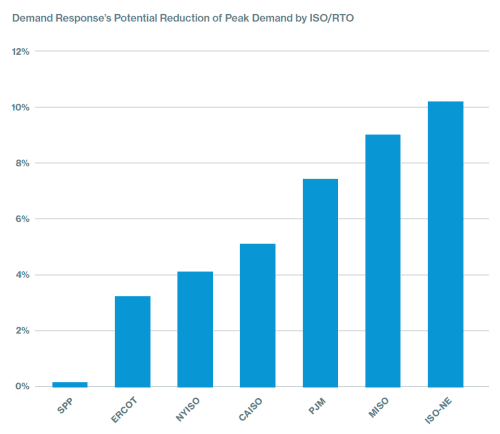

No other energy market in the US currently incorporates demand-reduction offers into the automated day-ahead and real-time energy dispatch system. ISO New England’s plans to implement this by June 2018 may make it the first US grid operator to accomplish this. ISO New England already has the most demand resources as a percentage of peak demand compared with other grid operators in the country, per a December 2015 report from FERC.

Source: Assessment of Demand Response and Advanced Metering Staff Report,

Federal Energy Regulatory Commission, December 2015

Learn more

- About demand resources in New England

- The ISO’s 10-year forecast of savings from the region’s energy-efficiency programs

- Categories

- Inside ISO New England

- Tags

- demand resources, FERC, market development