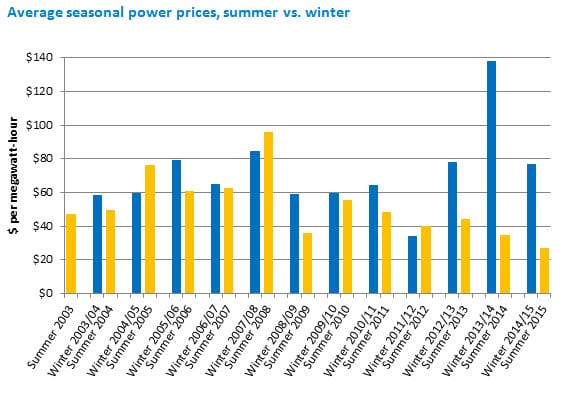

Summer 2015: The lowest natural gas and power prices since 2003

The summer of 2015 in New England stands out, but not because of the weather. Overall, the summer was relatively mild and consumer demand for electricity was about average. The reason this summer was remarkable: Wholesale power prices were the lowest they’ve been since the competitive wholesale electricity markets were launched in 2003. The average real-time wholesale electricity price for June, July, and August was $26.86 per megawatt-hour (MWh). The second-lowest summer average price occurred the previous summer, during June, July, and August of 2014, at $34.31.

The summer of 2015 in New England stands out, but not because of the weather. Overall, the summer was relatively mild and consumer demand for electricity was about average. The reason this summer was remarkable: Wholesale power prices were the lowest they’ve been since the competitive wholesale electricity markets were launched in 2003. The average real-time wholesale electricity price for June, July, and August was $26.86 per megawatt-hour (MWh). The second-lowest summer average price occurred the previous summer, during June, July, and August of 2014, at $34.31.

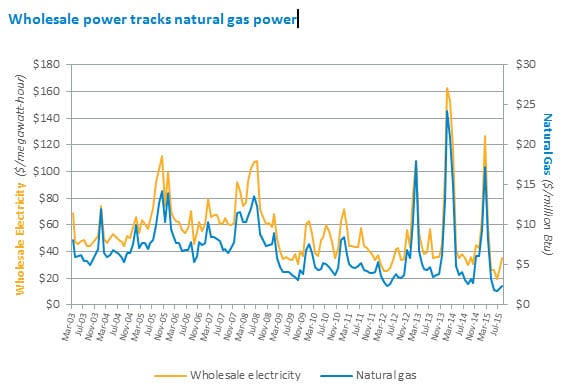

The region’s low summer prices illustrate that when New England power plants can access the vast supply of lower-priced, domestic natural gas being produced in the Marcellus shale deposit, power prices are low, on average. The high prices of the last few winters, conversely, illustrate what happens when the natural gas pipelines carrying that lower-priced natural gas from the west are running full or nearly full to meet heating demand: prices for natural gas go up, and so do wholesale power prices.

How Do these Prices Compare to those of Other Regions?

At $26.86/MWh, the average summer price for power in New England was, in fact, lower than the average summer price of $28.78/MWh recorded in the Midwest, where prices have typically been lower due to the greater use of regionally available, lower-cost fuels such as coal or natural gas. New England, on the other hand, has no indigenous sources of fossil fuels, such as natural gas, oil, or coal, which must be imported from outside the region. The region has a number of native hydro facilities, but low-cost renewable resources such as wind and solar still make up a small, but growing, portion of the region’s fleet.

New England’s wholesale electricity markets are competitive by all measures that evaluate factors such as the number of market participants and whether there is the presence of market power, and if power prices reflect the cost of inputs such as fuel. This summer’s prices indicate that the region’s electricity prices can be competitive, in the more commonly understood sense, with other regions of the US when low-cost fuel is available.

Why Were the Prices Lower?

In essence, the reason was the low price of natural gas that could be delivered to the power plants that burn natural gas to make electricity. For most of the year, the price of natural gas is low in New England, and as a consequence, the demand for natural gas for both heating and power generation just continues to grow. In fact, in 2014, New England power generators using natural gas produced 44% of the region’s electricity.

Because natural gas is the dominant fuel used to generate electricity in the region, this summer’s record-low natural gas prices flowed through to wholesale power prices. The average price of natural gas in New England during June, July, and August averaged $2/MMBtu, almost 40% lower than the next-lowest summer average (summer 2014, at $3.27/MMBtu). At times, in fact, the price of New England’s natural gas was lower than at the Henry Hub, a pricing point close to gas-producing areas in Louisiana. The Henry Hub is used as a price benchmark for natural gas, and typically has much lower prices than other areas of the country.

Why Are Prices Volatile?

This summer’s low prices throw the seasonal price volatility in New England into high relief. The major factor in power prices is the cost of fuel that power plants must buy to generate electricity. The low prices in June, July and August contrast sharply with the price spikes experienced just a few months before, in February 2015.

That month, which was the coldest since 1960 in New England, recorded the third-highest monthly average power price, at $126.70/MWh, since 2003. Due to heavy demand for natural gas for both heating and power generation, combined with pipeline constraints, the monthly average natural gas price during February was the fourth-highest since 2003, at $17.27 per million British thermal units (MMBtu). The first- and second-highest monthly average power prices were recorded the previous winter, in January and February 2014, at $162.88/MWh and $152.84/MWh, respectively, because the natural gas prices during those months were also the highest and second-highest seen since 2003. And recall that the second-lowest summer prices in New England were recorded in the summer of 2014, after those winter price extremes.

What Are the Effects of Lower Prices?

Customers won’t see high or low prices in the wholesale electricity market reflected in their retail bills right away. While wholesale electricity prices change every five minutes, retail rates in customers’ bills change at much longer intervals—usually every six months or a year. Utilities and competitive retail suppliers establish longer-term contracts for overlapping terms to even out the volatility in real-time wholesale power prices.

While low energy prices are beneficial for consumers, there are repercussions in the marketplace. Lower energy prices translate into lower revenues for power plants, and the region is starting to see the impact of that financial pressure in the growing number of retirements of coal, oil, and nuclear generators. The result has been shortfalls in the capacity needed to meet consumer demand in future years, and higher capacity prices coming out of recent Forward Capacity Market auctions.

Even though air conditioning use pushes up demand for power in New England to much higher levels in summer than in winter, power prices are usually lower in summer than in winter.

Even though air conditioning use pushes up demand for power in New England to much higher levels in summer than in winter, power prices are usually lower in summer than in winter.

Fast facts: Summers 2013-2015

| June, July, & August |

2013 | 2014 | 2015 |

|---|---|---|---|

| Average power price (MWh) | $43.94 | $34.31 | $26.86 |

| Average natural gas price (MMBtu) | $4.20 | $3.27 | $2.00 |

| Peak Demand (MW) | 27,379 | 24,443 | 24,398 |

| Total energy consumption (GWh) | 36,163 | 33,873 | 34,442 |

- Categories

- Inside ISO New England

- Tags

- summer, wholesale prices