Redesigned Regulation Market now in effect

Rollout was final step toward FERC requirements to adjust compensation mechanisms and expand participation to new technologies

Rollout was final step toward FERC requirements to adjust compensation mechanisms and expand participation to new technologies

On March 31, ISO New England’s redesigned Regulation Market went into effect, along with related updates to the eMarket application for market participants and the ISO dispatch software. The changes were a culmination of regional efforts begun in 2008 to address nationwide Federal Energy Regulatory Commission (FERC) requirements.

|

About frequency regulation Regulation is the capability of specially equipped resources to increase or decrease their energy output every four seconds in response to ISO signals. This “fine tuning” balances supply levels against small second-to-second variations in electricity use (demand) to help maintain transmission system frequency. Because frequency must be kept at 60 hertz across the entire Eastern Interconnection, each grid operator within the system must maintain that frequency. Regulation also helps maintain scheduled interchange between regions and is key to the secure and reliable operation of the grid. The Regulation Market selects and pays resources that provide regulation service for New England. |

Key features of the revamped market and systems include:

- A new auction design

- Changes in performance monitoring and compensation calculation

- A new type of dispatch signal to enable resources using new, alternative technologies to compete to provide frequency regulation services

Implementing the changes was a major ISO effort requiring careful study, analysis, and testing; the development of new dispatch algorithms; market rule revisions; significant software updates across several ISO computer systems; and revised operating procedures.

New dispatch: two regulation signals

The ISO has added a second type of regulation dispatch signal to give more resources the ability to provide regulation service.

Previously, the ISO (like many grid operators) used only a conventional signal that called for a resource to continuously produce electricity over a set period. While this type of signal worked for generators, it didn’t accommodate nongenerating resources based on a storage technology, such as batteries and flywheels. These resources can “fade” (lose their ability to follow a conventional signal) if their limited storage capacity becomes either fully charged or fully depleted over time.

Today, the ISO offers an energy-neutral signal, specific for such types of resources, which directs them to cycle between electricity production and consumption over a short period. This cycling cancels out to essentially no net energy use, which keeps storage-based resources from fading.

Alternative-technology regulation resources (ATRRs) of various types can now choose among two versions of the energy-neutral signal, as well as the conventional regulation dispatch signal used by generators. (See the Regulation Market presentation for more details.)

In addition, modifications were made to communications between the ISO and resources’ remote terminal units (RTUs) to support the coordinated dispatch of generation and nongeneration resources and to improve performance monitoring.

New auction design: two-part methodology to select and compensate regulation resources

As required by FERC, participants in the redesigned Regulation Market are now able to enter separate, resource-specific offers for provision of regulation service and regulation capacity. These offer components are used to calculate hourly prices and compensation. Resources receive:

- A capacity payment, which includes the opportunity costs of the marginal unit

- A performance payment reflecting the quantity of service provided (“mileage”) when following dispatch instructions

Compensation calculations, payments, charges, and reports were updated accordingly. (To learn more, read “Implementation of new Regulation Market to bring changes to settlements and MIS reporting.”)

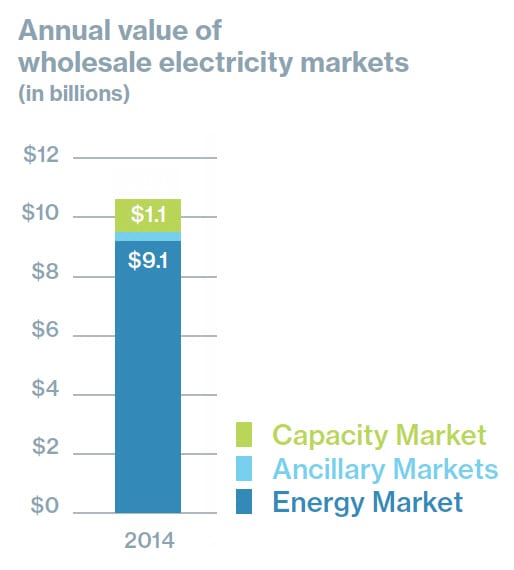

Totalling $29 million for 2014, the Regulation Market is one of

the ancillary markets, which together make up the smallest

portion of the region’s wholesale electricity marketplace.

Genesis of Regulation Market changes

In 2007, FERC Order 890, Preventing Undue Discrimination and Preference in Transmission Service, set the regulation market changes in motion. The order directed all US public utility transmission providers to enable demand resources and other nongeneration resources to provide regulation service. In 2011, FERC expanded requirements related to compensation with Order 755, Frequency Regulation Compensation in Organized Wholesale Power Markets. The ISO’s Order 890 compliance changes were incorporated into changes made for Order 755.

In preparation for the inclusion of ATRRs, the ISO ran an Alternative Technologies Regulation Pilot Program from 2008–2015 to understand the technical challenges ATRRs face in providing regulation service and to enable program participants to test their facilities and evaluate their viability in a realistic environment. The program yielded critical information and experience for developing the market-rule and system enhancements.

More information

- Market participants are encouraged to take the web-based training Regulation Market, which covers regulation basics, key regulation concepts, and recent changes to the market.

- The Regulation Market changes webinar includes a more detailed discussion of the new energy-neutral regulation signal and monitoring.

- For questions or assistance, please contact ISO Customer Support at custserv@iso-ne.com or (413) 540-4220.

- Categories

- Market Participant Information

- Tags

- energy storage, regulation market, settlements