New England power system performed well through winter 2014/2015

Now that the winter of 2014/2015 is one for the history books, this much we know is certain: no two New England winters are alike. A confluence of regional and global factors, advance planning and preparations, and delayed cold weather during winter 2014/2015 helped alleviate the operational issues and record-high prices seen during the previous winter.

Now that the winter of 2014/2015 is one for the history books, this much we know is certain: no two New England winters are alike. A confluence of regional and global factors, advance planning and preparations, and delayed cold weather during winter 2014/2015 helped alleviate the operational issues and record-high prices seen during the previous winter.

The primary factors that helped ensure power system reliability in New England and keep price volatility in check, include:

- The 2014/2015 Winter Reliability Program provided incentives to generators to have oil inventory stored on site, or to have a contract for LNG deliveries to supplement pipeline gas supplies before the start of winter.

- December was mild, and the coldest winter weather didn’t arrive until February, when days were longer and electricity consumption was lower.

- More liquefied natural gas (LNG) supplies were drawn to New England from world LNG markets, because of the region’s high natural gas prices during the previous winter and high forward prices for delivery during winter 2014/2015.

- Global oil prices dropped dramatically during 2014, making oil-fired generation often more economic to run than natural-gas-fired generation and dampening both gas and electricity price volatility.

- Energy-efficiency measures helped reduce total power consumption and peak demand.

As a result, New England’s generating resources and high-voltage power grid performed well throughout December, January, and February. Nevertheless, natural gas pipeline constraints continue to affect grid operations, wholesale energy costs, and the resource mix used to meet demand during the winter months.

2014/2015 winter weather

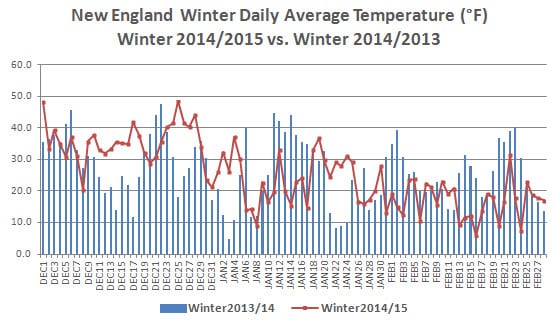

Weather is one of the biggest drivers of peak demand and overall power usage: milder temperatures translate into lower demand, and extreme temperatures push up demand. While the region experienced fairly moderate weather during December 2014, temperatures dropped in January and became downright arctic in February. With an average monthly temperature of 16.9°F in New England, February 2015 was the coldest month on record, based on ISO New England historical statistics, which date back to 1960.

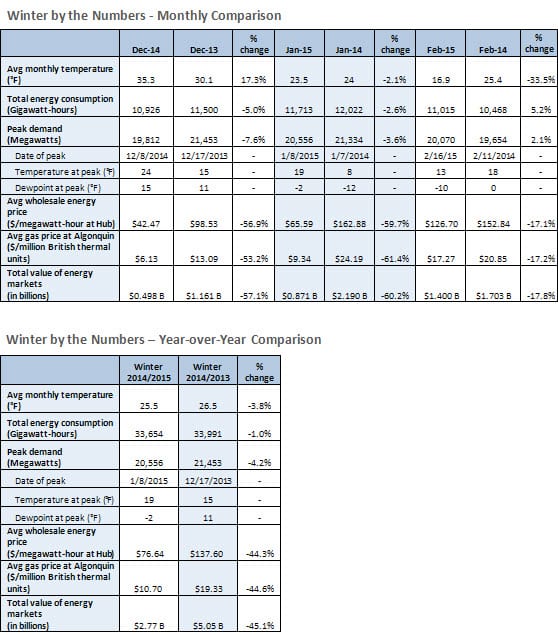

February 2015 set another record as the cold temperatures pushed up total energy usage higher than any other February. Yet, when considering the weather and temperatures were mild in December and average for January, peak demand and total winter electricity consumption were both lower than in winter 2013/2014:

- Demand for power reached its highest level on January 8, 2015, at 20,556 MW; the previous winter’s peak occurred on December 17, 2013, at 21,453 MW.

- New Englanders consumed 33,654 gigawatt-hours (GWh) of electricity from December 2014 through February 2015, slightly less than the 33,991 GWh consumed during the same period of the previous winter.

Although February was the coldest month, demand for electricity peaked in January for this winter period. As temperatures plummeted in February, consumer demand was lower because the holiday season had largely passed, which reduced the amount of electricity needed for decorative lighting. And in general, as the days grow longer, heating, lighting, and cooking activities don’t fall into such a narrow time frame when people arrive home.

Other reasons for lower peak demand and consumption include the frequent snow storms that led to schools, businesses, and in some cases government offices closing, as well as the effects of increased energy-efficiency in New England. Compared to the previous winter, regional energy-efficiency measures reduced peak demand by an additional 265 MW.

For detailed statistics, see the “Winter by the Numbers” tables below.

Winter power system operations

The New England power grid and the power plant fleet operated very well throughout the winter’s varying temperatures, so that sufficient resources were available to meet peak demand and provide reserves at all times.

“Given the difficulties we experienced the last few winters, we expected similarly challenging conditions this winter,” said Peter Brandien, vice president of system operations at ISO New England. “But from a system operations standpoint, the season was fairly uneventful overall, due mainly to preparations made well before the winter season began.

“Given the difficulties we experienced the last few winters, we expected similarly challenging conditions this winter,” said Peter Brandien, vice president of system operations at ISO New England. “But from a system operations standpoint, the season was fairly uneventful overall, due mainly to preparations made well before the winter season began.

“First, close coordination with natural-gas-fired generators and natural gas pipeline operators helped ensure grid reliability even when temperatures plummeted and demand for gas and power climbed,” continued Brandien. “Along with this, heavy injections of LNG into the eastern portion of New England’s system were helpful because this increased the amount of gas coming into the region, while circumventing the pipelines bringing in gas from the west, which were already running at full capacity throughout the winter. And once again, the Winter Reliability Program proved invaluable, significantly boosting oil inventory in the region before the start of winter. In February, generation from oil-fired power plants was especially critical in meeting demand for power when the weather turned bitterly cold, and also when LNG deliveries became intermittent when one LNG import terminal ran out of fuel and another terminal was unable to dock and unload cargoes because of poor weather conditions.”

Significant market improvements that took effect in December 2014 also contributed to improved generator performance. The energy market offer flexibility changes, for example, now allow generators to update their offers to sell energy during the operating day, so if the cost of fuel (e.g., natural gas) changes, they can reflect the updated price in their offers. Higher reserve prices have also been placed into effect for times when the system has limited power reserves and is at heightened reliability risk. Both of these market changes increase the financial incentives for generation owners to improve their fuel supply arrangements and generating plant performance.

System operators implemented Operating Procedure 4, Actions during a Capacity Deficiency once during the winter because of an event originating outside New England. On December 4, 2014, Hydro Québec experienced outages on two of its major transmission lines and had to significantly cut electricity exports to New England and other neighboring areas. The ISO brought additional generation online to maintain grid reliability in New England and also to provide support to our northern neighbors as they worked to restore their system to normal operations. OP-4 was implemented at 4:15 p.m. and was cancelled at 8:45 p.m. For the rest of the winter, power imports from Québec were regular and steady, and helped meet regional demand for electricity.

Winter Reliability Program boosted oil inventory, helped ensure reliability through record cold

![]() Given the resource performance challenges and reliability risks to the grid during the previous two winter seasons, ISO New England implemented a second Winter Reliability Program for 2014/2015 to address potential fuel-availability issues. Several elements of this winter’s program were consistent with the first, but there were also some fundamental differences, including the compensation structure. Under the 2014/2015 winter program, generators receive an end-of-season payment to help offset some—but not all—of the carrying costs associated with leftover oil inventory or unused LNG contracts. This design change was made to encourage generators that burn oil to rely on upfront inventory, rather than replenishments, and to incentivize natural-gas-fired generators to contract for LNG as a peaking fuel to augment the use of pipeline gas. Read more about the structure of the program.

Given the resource performance challenges and reliability risks to the grid during the previous two winter seasons, ISO New England implemented a second Winter Reliability Program for 2014/2015 to address potential fuel-availability issues. Several elements of this winter’s program were consistent with the first, but there were also some fundamental differences, including the compensation structure. Under the 2014/2015 winter program, generators receive an end-of-season payment to help offset some—but not all—of the carrying costs associated with leftover oil inventory or unused LNG contracts. This design change was made to encourage generators that burn oil to rely on upfront inventory, rather than replenishments, and to incentivize natural-gas-fired generators to contract for LNG as a peaking fuel to augment the use of pipeline gas. Read more about the structure of the program.

The program helped achieve the desired effect—by the start of the winter, the region was well positioned with fuel inventory: by December 1, 2014, 79 units (both oil-fired and dual-fuel) had more than 4 million barrels of oil in their fuel tanks. Like the previous winter, that oil inventory was instrumental in allowing the region to withstand the severe cold weather conditions.

From December through February, the region burned 2,717,500 barrels of program oil. Data showing the total amount of program oil used through March 15 (the end date of the oil aspect of the program) is being compiled.

While six natural-gas-fired generators participated in the winter program and arranged contracts for LNG, none of the contracts were utilized, likely because the contracted prices were higher than the cost of buying LNG or natural gas on the spot market this winter.

The 14 megawatts of demand-response resources participating in the program were activated once for a five-hour period during the OP-4 event in December.

Three resources with a total combined capacity of about 720 MW successfully commissioned dual-fuel capability this winter, under provisions of the Winter Reliability Program designed to promote these reliability-enhancing investments by power plant owners. Three other gas-fired facilities have committed to becoming dual-fuel capable by next winter.

Further analysis of the program is underway and will be shared with stakeholders in the coming weeks, but preliminary figures show that the total program cost will come in under $50 million, which is below the $66 million cost of the first winter program.

Greater fuel availability, lower fuel prices helped reduce wholesale electricity prices

Wholesale electric energy prices during winter 2014/2015 were well below the previous winter’s prices: the average cost of wholesale electric energy from December 2014 through February 2015 was $76.64/megawatt-hour (MWh), while last winter’s average price was $137.60/MWh.

The total cost of wholesale energy from December 2014 through February 2015 was $2.77 billion, 45 percent less than the $5.05 billion for the same three-month period the previous winter. The overall lower wholesale energy costs can be credited to increased supplies of LNG to the region and lower oil and natural gas prices. For more information on wholesale prices, see the “Winter by the Numbers” tables below.

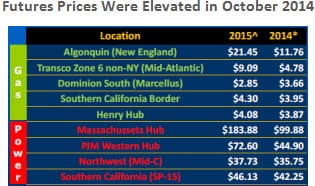

Source: Winter 2014-15 Energy Market Assessment, FERC, October 16, 2014More LNG attracted to New England

Source: Winter 2014-15 Energy Market Assessment, FERC, October 16, 2014More LNG attracted to New England

LNG is a globally-priced commodity and its availability in New England is dependent on worldwide demand. New England’s record-high natural gas and wholesale energy prices during winter 2013/2014, along with high forward prices late last year, provided strong economic signals to LNG suppliers to bring tankers to the region this winter. An October 2014 FERC analysis noted that winter futures prices in New England for both natural gas and power were the highest in the US.

In addition, the estimated landing prices for LNG revealed that the New England region was predicted to have the highest prices in the world—and nearly twice as high as prices in Europe, Asia, and South America.

Source: National Natural Gas Market Overview, FERC, December 2014 (slide 13). (Source data from Waterborne Energy, Inc.)

According to the Northeast Gas Association (NGA), both the Distrigas LNG terminal in Everett, MA, and the Canaport LNG terminal in New Brunswick, Canada, recorded steady throughput this winter, and the Northeast Gateway facility, located offshore from Gloucester, MA, received its first LNG shipment in four years, in January 2015 (Source: Regional Market Update, Northeast Gas Association, March 20, 2015, slide 9).

From December through February, New England saw the injection of about 31 Bcf of gas from LNG imports into the region—nearly twice as much as the 16 Bcf of gas from LNG imports the previous winter.

“LNG was in substantially greater supply this winter than last, and this additional LNG heightened competition in the wholesale fuels markets which, in turn, helped moderate the cost of both pipeline gas and LNG this past winter,” explained Matthew White, Chief Economist at ISO New England. “Compared to winter 2013/2014, the increased fuel supplies resulted in much lower price levels this winter.”

“LNG was in substantially greater supply this winter than last, and this additional LNG heightened competition in the wholesale fuels markets which, in turn, helped moderate the cost of both pipeline gas and LNG this past winter,” explained Matthew White, Chief Economist at ISO New England. “Compared to winter 2013/2014, the increased fuel supplies resulted in much lower price levels this winter.”

However, while increased competition in the gas market helped to dampen prices over the course of the winter, the amount of Marcellus shale gas that could be delivered to the region from the west remained limited by New England’s constrained pipeline system. During many cold days in February, daily spot-market natural gas prices hovered in a range of $20 to $30 per million British thermal units (MMBtu), which is high by historical standards. These higher gas prices increased winter wholesale electricity prices: February’s average wholesale energy price was $126.70/MWh, which makes it the third-highest average monthly wholesale energy price in New England. The highest and second-highest prices were logged the previous winter, during January and February 2014, respectively.

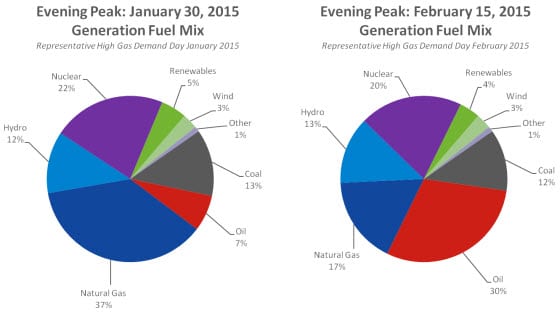

Lower oil prices and diverse fuel mix also helped moderate energy prices, meet demand

Worldwide oil prices fell to approximately half what they were the previous winter, which dramatically reduced the cost of operating oil-fired power plants. While nuclear and natural gas were the dominant fuels used to produce power this winter, oil and coal resources were competitively priced and, at times, were a large part of the fuel mix—especially during the coldest month of February 2015. On some days, oil and coal together fueled more than 40% of the region’s power needs, as shown in the pie chart.

“The New England wholesale electricity market experienced the effects of the drop in oil prices, just as automobile drivers have seen relief at the gas pump over the past several months,” White explained. “The plunge from $100/barrel oil in winter 2013/2014 to less than $50/barrel oil this winter made oil-fired power plants price-competitive with coal-fired and even high-efficiency gas-fired plants. Coupled with the increased competition in the natural gas markets that helped keep a lid on the price of natural gas for much of the winter, low oil prices put downward pressure on the cost of wholesale energy, helping to curb wholesale power prices well below those of the previous winter of 2013/14.”

Implications for future winters

Many of the factors that contributed to smooth power grid operations and lower wholesale energy prices this winter are difficult to predict, and resulted in part from changing conditions in global fuel markets. Importantly, it remains to be seen whether they will recur similarly in future winters.

Natural gas pipeline constraints![]() The interstate natural gas pipelines serving New England continue to be utilized at full or near-full capacity during the winter months, which contributes to higher prices here compared to other US regions. Further, most of the natural gas flowing through pipelines during the winter serves customers using it to heat their homes and businesses. As more and more residences and businesses convert to natural gas for heating purposes, the pipeline system serving the region will become progressively more constrained, further limiting the gas supply available to power generators in the winter. While utilities, private investors, and the states are discussing various proposals for expanding pipeline capacity, any significant relief is at least several years away.

The interstate natural gas pipelines serving New England continue to be utilized at full or near-full capacity during the winter months, which contributes to higher prices here compared to other US regions. Further, most of the natural gas flowing through pipelines during the winter serves customers using it to heat their homes and businesses. As more and more residences and businesses convert to natural gas for heating purposes, the pipeline system serving the region will become progressively more constrained, further limiting the gas supply available to power generators in the winter. While utilities, private investors, and the states are discussing various proposals for expanding pipeline capacity, any significant relief is at least several years away.

LNG import variability

LNG tankers follow the money around the world each winter. Consequently, the LNG imports that helped increase gas supplies in the region this winter—and helped moderate prices—were here because of last winter’s (2013/2014) high prices. If another part of the world experiences high LNG demand as the global economy recovers, global LNG suppliers may no longer find New England their preferred destination in future winters. Lower LNG supplies in future winters would exacerbate New England’s gas pipeline constraints and infrastructure challenges, and heighten the potential for a return to the high wholesale energy prices experienced in winter 2013/2014.

Uncertainty of future oil prices

Low oil prices resulted in greater dispatch of oil-fired power plants this winter, which helped to dampen the price of wholesale electricity. However, global oil markets—and therefore oil prices—are notoriously fickle. Should oil prices go back up, the cost of operating oil-fired power plants will rise as well.

![]() Generator environmental limits

Generator environmental limits

Increased operation of oil- and coal-fired plants comes with environmental costs for the region: greater air emissions. For example, New England’s generator air emissions figures increased in 2013, as higher-emitting units were needed more often to serve peak demand and to make up for decreased natural gas-fired generation during the winter months. Additionally, the runtimes of generators that burn oil are limited by state and federal emissions restrictions and the potential for these limitations will continue to be a factor during future winter operations.

Resource retirements

The continued retirements of aging oil and other non-gas generators from the region’s fleet of power plants will further increase New England’s reliance on natural gas for power production and exacerbate natural gas infrastructure constraints. In 2014, two large power plants went offline permanently: the remaining coal and oil units at Salem Harbor station (585 MW) and the Vermont Yankee Nuclear station (615 MW). Brayton Point Station—a 1,535 MW coal- and oil-powered plant that the region relied on heavily throughout the 2014/2015 winter—will be retired by June 1, 2017, and as many as 6,000 MW of other non-gas resources are at risk for retirement in coming years. In total, the retirements from 2014 through 2018 represent more than 10% of the region’s generating capacity.

Ensuring reliability during the winter months

ISO New England has made longer-term changes to the Forward Capacity Market design, most significantly Pay-for-Performance, which will create strong incentives for generators to firm up their fuel supply and improve their overall performance. These changes will take effect in 2018. In the interim, the ISO has used targeted reliability programs that have improved regional fuel adequacy and maintained grid reliability for the past two winters. Earlier this year, the Federal Energy Regulatory Commission (FERC) required ISO New England to implement a market-based solution for the winters between now and 2018. Citing the difficulty in creating a market-based solution on top of the existing patchwork of generator obligations, ISO New England has asked FERC to permit the continuation of the winter reliability programs—with an expanded scope to include more resource types—until new performance and investment incentives take effect. If this request isn’t accepted by FERC, the ISO will propose a seasonal increase in energy market reserve pricing during times of system stress—the only market-based solution that can be implemented before next winter. However, the ISO has concerns that changes to the energy market may not provide the same assurances of “fuel in the tank” as the recent winter reliability programs.

More information

For background on how natural gas infrastructure constraints, resource retirements, and other challenges are affecting the grid, see the 2015 Regional Electricity Outlook.

- Categories

- Inside ISO New England

- Tags

- energy efficiency, peak demand, system operations, winter