How wholesale electricity costs factor into your retail bill

Limited natural gas availability is driving up wholesale electricity prices and ultimately retail prices

Limited natural gas availability is driving up wholesale electricity prices and ultimately retail prices

Every month, consumers across New England receive an electric bill from their local utility that includes charges associated with keeping the lights on. A typical residential electric bill generally includes two types of charges: the cost of delivering power and the cost of power itself.

The costs of delivering power include charges related to the administration, operation, and maintenance of the high-voltage transmission system and the lower-voltage distribution lines. Consumers may also see other line items on their bill that help fund the advancement of state public policy goals, such as energy efficiency and renewable energy, and other charges that vary by state.

The cost of the electricity itself is typically listed separately—usually referred to as either the supply charge, energy charge, default service, or basic service—and that’s based on the wholesale price of power.

Together, the delivery and supply charges make up the total retail electric bill.

The wholesale to retail connection

Wholesale electricity prices rise and fall throughout the day—every five minutes, in fact—but consumers generally see their rates change at set intervals depending on the state and utility. Most consumers (with the exception of Vermont) have two options to purchase their electricity: they can rely on their utility company to purchase electricity supply on their behalf or they can elect to go with a competitive retail supplier. The public utilities department or commission in each of the five states that offer retail choice typically licenses and maintains a list of eligible retail suppliers on their website.

The supply portion of the bill may be set for six months, a year, or other interval because utilities and competitive retail suppliers establish contracts for electric generation for overlapping terms to help even out the volatility in real-time wholesale power prices. So, high or low prices in the wholesale electricity market won’t be reflected right away in retail bills, but will be reflected in the supply portion of the bill over time as new contracts are negotiated for the next rate period. The rates that utilities charge to buy wholesale energy are under the jurisdiction of the public utilities commission in each state and must be approved by the commission to take effect.

This web page provides additional information on the wholesale-to-retail electricity price connection.

Recently announced supply rate increases by New England utilities likely reflect the trend of high prices seen in the wholesale energy market last winter, which in turn was largely driven by high natural gas prices.

New England’s increasing dependence on natural gas to produce electricity

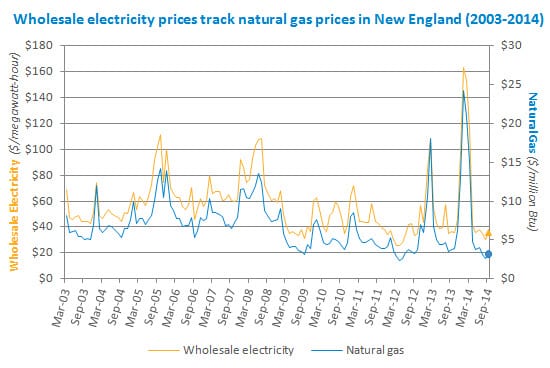

In 2000, 15% of the power produced in New England came from natural gas generation; by 2013, 46% of the power came from natural gas plants. One of the main reasons for this shift in production, especially in recent years, is that the price of natural gas has been very low on average due to increased domestic production, including from the Marcellus shale.

With so many natural gas power plants producing so much of the region’s electricity, wholesale electricity prices and natural gas prices move in tandem in New England. In recent years wholesale power prices have been low on average because of the generally lower natural gas prices. Lower natural gas prices also have encouraged more and more homes and businesses to convert to natural gas for heating, a trend that continues today. However, while the region has seen a significant increase in demand for natural gas, the pipelines that carry the gas into New England have not expanded at the same pace, and have become increasingly constrained. This is observed especially on very cold winter days.

2013/2014 winter grid operations and rising wholesale energy prices

During last winter’s cold spells, demand for natural gas for both heating and power generation soared, sparking a supply-and-demand dynamic: increased demand and limited supply led to higher prices. The region’s congested natural gas pipeline infrastructure caused natural gas prices to spike—in fact, natural gas was more expensive than coal and oil during many winter days. In addition, many of the pipelines were operating at or near full capacity, with most of the gas dedicated to serve home and business heating customers. As a result, system operators turned to oil and coal plants more frequently in order to keep the lights on in New England.

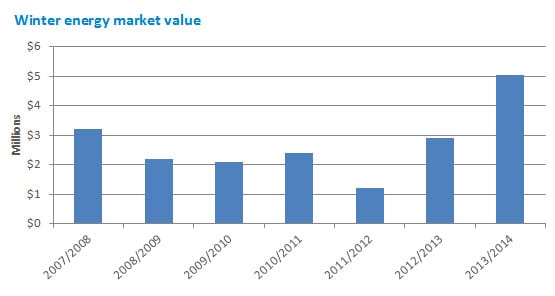

For the three months of winter 2013/2014 (December, January and February) the wholesale cost of power totaled about $5 billion in New England. By comparison, for the entire 12 months of 2012, when natural gas prices were at record lows, the wholesale cost of power totaled $5.2 billion, with winter 2011/2012 making up $1.2 billion of the total. The following winter, 2012/2013, which included a January cold snap and Winter Storm Nemo, totaled $2.9 billion.

As mentioned above, many New England ratepayers will soon start to see the impact of last winter’s price spikes when they open their electric bills.

Implications of constrained natural gas pipelines on grid reliability

While natural gas pipeline constraints can lead to higher natural gas and wholesale electricity prices, the ISO is concerned about the growing threat to power grid reliability that is resulting from the region’s growing dependence on natural gas for electricity production and the increasing issues related to fuel availability.

Over the past two winters, the ISO has seen grid reliability affected as a direct result of pipeline constraints. Read the following articles recapping the previous two winters to learn more about the challenges faced by ISO system operators:

- Oil inventory was key in maintaining power system reliability through colder-than-normal weather during winter 2013/2014

- New England grid operated reliably through 2012/2013 winter despite resource performance challenges

For more information on pipeline constraints and natural gas and wholesale power prices in New England:

- Energy Information Administration, Residential electricity prices are rising, September 2, 2014

- Energy Information Administration, Northeast and Mid-Atlantic power prices react to winter freeze and natural gas constraints, January 21, 2014

- Energy Information Administration, New England and New York have largest natural gas price increases in 2013, January 7, 2014

- Categories

- Industry News & Developments

- Tags

- natural gas, wholesale markets, wholesale prices