Oil inventory was key in maintaining power system reliability through colder-than-normal weather during winter 2013/2014

The frigid temperatures that gripped much of the nation this winter posed operational challenges to the New England power grid, led to spikes in natural gas and wholesale electricity prices, and further highlighted issues related to resource performance and the importance of a secure fuel supply. In light of these challenges, here and across the country, the Federal Energy Regulatory Commission (FERC) hosted a Technical Conference on April 1, to hear from ISO New England, New York ISO, PJM Interconnection, Southwest Power Pool, Midcontinent ISO, California ISO, and other industry representatives about the impact of the cold weather on power system operations in different parts of the country.

The frigid temperatures that gripped much of the nation this winter posed operational challenges to the New England power grid, led to spikes in natural gas and wholesale electricity prices, and further highlighted issues related to resource performance and the importance of a secure fuel supply. In light of these challenges, here and across the country, the Federal Energy Regulatory Commission (FERC) hosted a Technical Conference on April 1, to hear from ISO New England, New York ISO, PJM Interconnection, Southwest Power Pool, Midcontinent ISO, California ISO, and other industry representatives about the impact of the cold weather on power system operations in different parts of the country.

Peter Brandien, ISO New England’s vice president of system operations, gave a presentation about the ISO’s preparations prior to winter, grid operations throughout the winter, wholesale market impacts, and implications for future winters. Access a video of the full conference. The following article summarizes some of the ISO’s key observations from this winter.

Below-average temperatures

Cold weather came early to New England this winter, beginning in early December; January ranked among the coldest months in recent history; and temperatures dropped well below the 20-year historical average during multiple periods.

Heavy demand for natural gas resulted in pipeline constraints, price volatility

Demand for gas in New England has risen significantly over the past several years, driven by residents and businesses converting to natural gas for heating purposes and the increased use of the fuel to generate electricity. However, the existing natural gas pipeline infrastructure was not designed to serve this increasing demand, which has resulted in pipeline constraints at times of heavy demand.

As temperatures dropped in the region this winter, demand for natural gas soared; in fact, at times, all five natural gas pipelines that serve New England were operating at or near full capacity. Some of the pipelines saw record throughput.

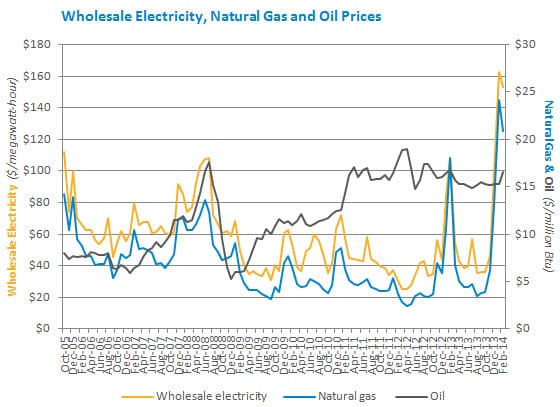

The heavy demand for natural gas combined with a constrained delivery system caused extreme volatility in gas prices. Gas prices during December, January and February averaged $19.33 per million British thermal units (MMBtu) at the Algonquin pipeline delivery point in Massachusetts—almost double what they were during the 2012/2013 winter when the average price for gas was $11.28/MMBtu. In January, the average natural gas price rose to $24.19/MMBtu at the Algonquin delivery point, the highest average price in more than 10 years. The daily gas price spiked to a high of more than $78/MMBtu on a day in January.

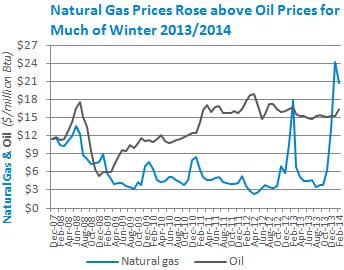

The sustained high prices resulted in an uncommon reversal of the relative price of oil and natural gas—for much of the winter, gas was often more expensive than oil. This price inversion has rarely happened since 2008, when domestic production of natural gas from the Marcellus shale deposits in Pennsylvania began to increase significantly, leading to lower natural gas prices in New England and other parts of the country. While the average price of natural gas for the months of December, January, and February was $19.33/MMBtu, the average New England oil price for the same time was significantly lower, at $15.72/MMBtu.

The sustained high prices resulted in an uncommon reversal of the relative price of oil and natural gas—for much of the winter, gas was often more expensive than oil. This price inversion has rarely happened since 2008, when domestic production of natural gas from the Marcellus shale deposits in Pennsylvania began to increase significantly, leading to lower natural gas prices in New England and other parts of the country. While the average price of natural gas for the months of December, January, and February was $19.33/MMBtu, the average New England oil price for the same time was significantly lower, at $15.72/MMBtu.

Diverse fuel mix used to meet demand

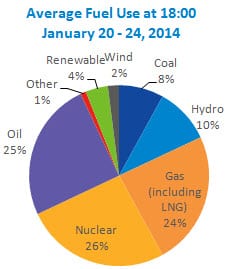

During certain times of the year when there is less demand for natural gas (and prices are usually lower), natural-gas-fired power plants typically produce about half of the electricity generated in the region, and oil- and coal-fired resources run infrequently. However, when the price of gas exceeds the price of oil and coal, both of those fuels become “economic” in the wholesale energy markets, and generators that use oil and coal to produce electricity are dispatched by the ISO prior to more expensive natural-gas-fired units. This has an impact on both the generation fuel mix and the cost of wholesale electricity.

During certain times of the year when there is less demand for natural gas (and prices are usually lower), natural-gas-fired power plants typically produce about half of the electricity generated in the region, and oil- and coal-fired resources run infrequently. However, when the price of gas exceeds the price of oil and coal, both of those fuels become “economic” in the wholesale energy markets, and generators that use oil and coal to produce electricity are dispatched by the ISO prior to more expensive natural-gas-fired units. This has an impact on both the generation fuel mix and the cost of wholesale electricity.

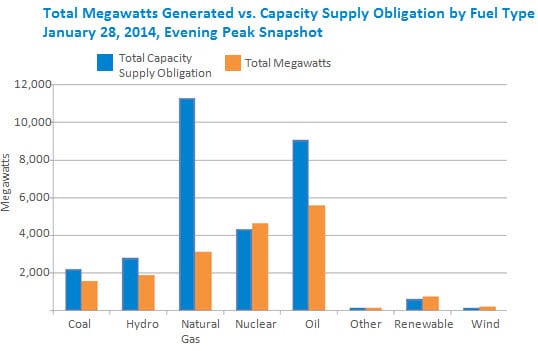

Throughout the winter, much of the oil fleet was running at full capacity, even through the nighttime hours when demand is lower. Coal-fired-generators were also running more often than usual. While oil-fired generation produced much more electric energy than in recent years, and other non-gas generators neared their capacity limits, natural-gas-fired power plants produced far less than their total capacity.

On certain cold days, when the natural gas pipelines in New England were running full, very few gas-fired generators were producing power. For example, on January 28, when temperatures were very cold, gas generators produced only about 3,000 MW during the peak demand hour, although there was more than 11,000 MW of natural-gas generating capability. Therefore, other parties were using natural gas, most likely to heat homes and businesses. This signals that the pipelines delivering natural gas to New England are even more constrained than previously understood. Further, it raises questions about the viability of using natural-gas-fired resources to satisfy operating reserves.

Wholesale energy prices increased

Wholesale energy prices increased

Wholesale electricity prices also spiked and remained extremely high throughout the winter. The average cost of wholesale electric energy during the months of December, January and February was $137.59/megawatt-hour (MWh), about 77% higher than the previous winter, when prices averaged $77.69/MWh from December 2012 through February 2013.

The total value of the wholesale energy market in December, January, and February, was about $5.05 billion. For comparison, the value of energy market transactions in 2012—the year that averaged the lowest wholesale power prices since 2003—was $5.2 billion for the entire 12 months.

To read more about wholesale energy prices and drivers, see the monthly market price articles on the ISO Newswire.

Oil inventory was instrumental in keeping the lights on

Given the resource performance challenges and reliability risks to the grid during winter 2012/2013 as a result of inadequate fuel availability by a number of generators (some natural gas power plants could not access fuel to run and some oil generators that began with limited oil inventory ran out of fuel and could not run), ISO New England was concerned that if winter 2013/2014 was colder than winter 2012/2013, the region would not have enough capacity available to serve demand.

Therefore, the ISO proposed (and FERC approved) the Winter Reliability Program (WRP), which ran from December 1, 2013, through February 28, 2014. The program procured commitments from oil-fired and dual-fuel generators to provide increased levels of fuel inventory, and from demand-response resources to reduce consumption when dispatched. Commitments capable of producing about 1.9 MWh of power and demand reductions were procured at a projected cost of about $75 million. The program focused on oil- and dual-fuel generators because they can buy and store the fuel they need in advance and the amount of oil in their tanks can be tracked. Additionally, a combination of oil and dual-fuel units and demand response was selected in order to minimize impact on the current energy markets.

The WRP began with an initial inventory of about 3 million barrels of oil in generators’ tanks with the ability to replenish another 485,000 million barrels of oil over the course of the winter. By the end of February, about 2.7 million barrels of oil from program participants had been burned, or the equivalent of approximately 1.6 million MWh.

This oil inventory was instrumental in helping maintain system reliability this winter. With the WRP, system operators were able to manage the power grid through periods of extreme cold because oil-fired and dual-fuel generators had the fuel needed to run when dispatched, as outlined in the ISO’s Winter Operations Summary: January – February 2013.

Despite operational challenges, system reliability was maintained

While ISO system operators were able to manage the system reliably throughout the winter, they still faced many challenges.

While ISO system operators were able to manage the system reliably throughout the winter, they still faced many challenges.

When oil-fired generators run as heavily as they did this winter, they deplete their stocks of oil very rapidly. Even with the supplies secured through the WRP, which helped increase the amount of oil in participating generators’ tanks prior to the winter season, many oil and dual-fuel generators burned through their supplies and experienced difficulty in securing additional oil inventories. Oil replenishment during winter months in New England can be challenging due to weather conditions, but has become even more so as the oil supply chain has diminished in the past several years. Furthermore, the entire Northeast was looking to replenish fuel supplies during the same cold weather periods. A number of resources had trouble securing oil transportation, which was slowed due to harsh weather and competition for the barges and trucks required to move the fuel.

Further, conditions outside of New England affected system operations. As the cold weather gripped much of the country, neighboring power grids also experienced heavy demand and tight system conditions at times; in fact, the regions of the country served by the Midcontinent Independent System Operator, PJM Interconnection, and New York ISO each set new all-time winter peak demand records. Because the New England grid is closely connected to other operating areas, conditions outside of New England can quickly affect the region if the amount of scheduled power being imported or exported changes unexpectedly.

Looking ahead

New England has made it through the past two winters by relying heavily on non-gas-fired resources, but the power system landscape is changing rapidly.

By next winter, Vermont Yankee in southern Vermont and Salem Harbor units 3 and 4 in the Greater Boston area will be retired, which means approximately 1,200 MW fewer non-gas resources will be available to meet consumer demand and maintain system reliability. To put this into perspective, the Winter Reliability Program procured less than the combined capabilities of Vermont Yankee and the retiring Salem Harbor units.

ISO New England is reviewing 2013/2014 winter operations and is evaluating if additional incentives will be necessary for the upcoming winter of 2014/2015.

As part of its Strategic Planning Initiative, the ISO is implementing several wholesale market rule changes that will be in place by the 2014/2015 winter. These new rules are expected to help address some of the resource availability concerns and include energy market offer flexibility rules, scheduled to go live in early December 2014. These changes will allow power supply offers to be updated in real time to reflect changes in actual fuel prices, helping generators better adjust to short-term fuel arrangements or high, real-time fuel prices. More accurate energy-market pricing provides the appropriate signals (or incentives) for resources to perform, thus further improving grid reliability.

As part of its Strategic Planning Initiative, the ISO is implementing several wholesale market rule changes that will be in place by the 2014/2015 winter. These new rules are expected to help address some of the resource availability concerns and include energy market offer flexibility rules, scheduled to go live in early December 2014. These changes will allow power supply offers to be updated in real time to reflect changes in actual fuel prices, helping generators better adjust to short-term fuel arrangements or high, real-time fuel prices. More accurate energy-market pricing provides the appropriate signals (or incentives) for resources to perform, thus further improving grid reliability.

- Categories

- Inside ISO New England

- Tags

- FERC, generation, natural gas, system operations, wholesale markets, wholesale prices, winter