ISO-NE and NEPOOL submit proposal to establish sloped demand curve for future Forward Capacity Market auctions

A sloped demand curve will moderate price volatility and eliminate administrative pricing

A sloped demand curve will moderate price volatility and eliminate administrative pricing

ISO New England and the New England Power Pool have filed a joint proposal with the Federal Energy Regulatory Commission to establish a sloped demand curve for use in future Forward Capacity Market (FCM) auctions. Each year, ISO New England holds an auction to purchase the amount of capacity (both generation and demand-side resources) that will be needed to satisfy demand for electricity for a one-year commitment period three years into the future.

Each of the eight forward capacity auctions (FCAs) to date has sought to procure a fixed amount of capacity, regardless of the auction clearing price. Through the first seven auctions, the New England power system had surplus capacity that exceeded the capacity requirement (with the exception of one zone in FCA #7), and therefore the auctions cleared at relatively low prices. However, the eighth auction, conducted on February 3, 2014, concluded with a slight shortfall in capacity and relatively high prices. The shift in future available capacity drove a large swing in capacity prices: through the first seven FCAs, prices ranged from $2.52 per kilowatt-month (kW-month) to $3.43/kW-month, while FCA #8 yielded a clearing price of $15.00/kW-month for new resources. Further, because of a lack of competition, administrative pricing rules were triggered, setting the capacity prices for most existing resources at $7.025/kW-month.

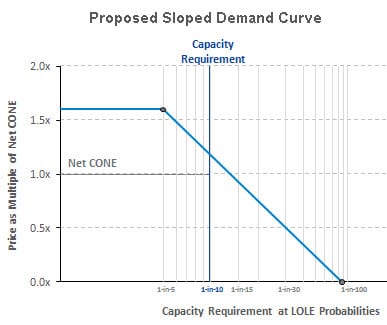

Under the proposal, the sloped demand curve would replace the fixed capacity requirement value as the determinant of system-wide capacity demand for purposes of clearing the auction. The shape of the sloped curve is based on both financial and reliability parameters. These parameters include the estimated cost of new entry (CONE) for a new resource and well-established system planning design criteria that are based on the probability of disconnecting load due to a resource deficiency (also referred to as Loss of Load Expectation or LOLE). The curve’s prices are indexed to an estimated Net CONE value (the estimated CONE net of revenues from energy, reserve and other markets). The proposed Net CONE value is $11.08/kW-month, with prices rising above that if reserve margins become low and prices declining below Net CONE at higher reserve margins. The CONE values are based on 2×1 combined-cycle gas turbine technology—a widely used technology across the country and the type of technology used by the most recent merchant generation plant that cleared the New England capacity market.

Under the proposal, the sloped demand curve would replace the fixed capacity requirement value as the determinant of system-wide capacity demand for purposes of clearing the auction. The shape of the sloped curve is based on both financial and reliability parameters. These parameters include the estimated cost of new entry (CONE) for a new resource and well-established system planning design criteria that are based on the probability of disconnecting load due to a resource deficiency (also referred to as Loss of Load Expectation or LOLE). The curve’s prices are indexed to an estimated Net CONE value (the estimated CONE net of revenues from energy, reserve and other markets). The proposed Net CONE value is $11.08/kW-month, with prices rising above that if reserve margins become low and prices declining below Net CONE at higher reserve margins. The CONE values are based on 2×1 combined-cycle gas turbine technology—a widely used technology across the country and the type of technology used by the most recent merchant generation plant that cleared the New England capacity market.

The demand curve proposal also includes an increase in the number of years new resources can choose to “lock-in” their capacity price. The extension of the lock-in period from five years to seven years is intended to ensure that the overall market design provides sufficient certainty to attract new investment when needed.

Additionally, the changes include a limited exemption from the buyer-side mitigation rules for renewable technology resources that are built specifically to advance state policy objectives. Under the current rules, new resources must submit offer prices above a specified offer floor price (based on the resource type). These rules are in place to help mitigate potential price suppression that can occur when a particular class of resources receives compensation not available to others. For example, renewable resource projects, such as wind and solar, often receive subsidies. The proposed exemption will allow up to 200 megawatts (MW) of capacity from renewable technology resources to participate in each auction without having to offer in above the offer floor price for their resource type. Eligibility for the exemption is limited to new resources that qualify under state renewable or alternative energy portfolio standards and that are located in the state in which they qualify. This change is intended to accommodate state policies that favor renewable resources and that are not intended to suppress market-clearing prices, while sufficiently limiting the amount of resources that are exempt to alleviate design concerns.

Introducing a downward-sloping demand curve into New England’s FCA has the potential to reduce price volatility over time, yielding smaller swings in capacity prices when the market moves from conditions of excess supply to periods when new capacity resources are needed, which may occur as aging power plants retire. Adding a demand curve will also allow the removal of administrative pricing triggers, such as the Insufficient Competition rule that was implemented in the last auction, FCA #8.

If approved, the sloped demand curve would be utilized in the next FCA to be held in February 2015. The ISO has requested an effective date of June 1, 2014, to allow enough time for rule changes to be completed prior to qualification deadlines related to FCA #9.

- Categories

- Inside ISO New England

- Tags

- forward capacity market, market development