FERC accepts ISO-NE and NEPOOL proposal for flexible energy supply offers in real time

This market enhancement is another step toward improving

resource performance and mitigating natural-gas dependence risks

The Federal Energy Regulatory Commission (FERC) gave conditional acceptance in early October to a joint proposal from ISO New England and the New England Power Pool (NEPOOL) to allow flexible supply offers in the real-time energy market. Implementation is scheduled for early December 2014. These “offer flexibility changes” are one more step in the ISO’s Strategic Planning Initiative (SPI).

Improved price signals and reliability

The proposal will allow power supply offers to be changed in real time to reflect changes in actual fuel prices, helping generators better adjust to short-term fuel arrangements or high, real-time fuel prices. More accurate energy-market pricing provides the appropriate signals (or, incentives) for resources to perform, thus further improving grid reliability. FERC accepted the joint proposal on the condition that the ISO file conforming language changes to the Transmission, Markets and Services Tariff by January 17, 2014.

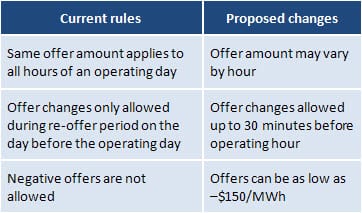

Under the rule revisions accepted by FERC, participants will be able to submit:

- power supply offers that vary by hour in the Day-Ahead Energy Market—current rules require the same offer for all hours of an operating day

- timely changes to offers (until 30 minutes before the hour in which the offer would apply) in the real-time market—current rules restrict changes to a brief “re-offer period” on the day before the operating day

- negative offers as low as –$150/MWh. This lowering of the “energy offer floor” (which is currently $0/MWh) helps accommodate market participants with resources that can operate economically or can increase consumption at very low energy prices, and is more consistent with offer floors used in other regions.

“Self-scheduling” changes also being proposed

Currently, market participants can set an economic minimum limit for dispatch—a desired minimum output level for operating a generating resource. Sometimes, this apparent reduction in a resource’s dispatchable range can artificially create excess generation conditions (a “minimum generation emergency”), requiring system operators to take administrative actions and/or implement administrative pricing to resolve the situation.

To alleviate this, proposed changes will allow market participants to submit a request for a resource to be dispatched at a specific output level.

Correcting a misalignment with natural gas markets

Because natural gas prices fluctuate throughout the day, the current limits on hourly variability and offer changes can create a mismatch between a generator’s day-ahead supply offer and its actual fuel costs. For example:

- If on the operating day, natural gas prices are higher than expected, the generator’s day-ahead power supply offer may be below actual production costs, resulting in a financial loss.

- On the other hand, lower-than-expected natural gas prices may reduce the competitiveness of the generator’s offer, resulting in higher-than-necessary costs for buyers.

Both situations are becoming more common because of increased volatility in fuel prices.

Mitigation changes

The proposed changes will require substantial revision of mitigation rules. For example, the ISO’s Internal Market Monitor will need to develop hourly reference levels for generators rather than a single reference level for an entire operating day.

More information

For more detail on the proposal, the July 1, 2013, ISO/NEPOOL filing to FERC is available online.

Learn more about the Strategic Planning Initiative and read related ISO Newswire articles:

- Categories

- Inside ISO New England

- Tags

- market development